Feeding America's Domestic Livestock and Pets Is Essential

The animal food industry is essential. A December 2020 report found that America’s domestic livestock and pets chowed down on nearly 284 million tons of safe, high quality and nutritious food in 2019, supporting their healthy growth and development. The report also provided expert economic analysis on how the coronavirus pandemic may impact the industry’s growth through 2025.

About the Study

The Insititute for Feed Education and Research (IFEEDER) led the research project, which quantified exactly how much animal food domestic livestock and pets consume throughout the various stages of their lives, adjusting for regional feed differences and life stages. Also, utilizing the U.S. Department of Agriculture’s November 2020 data, Decision Innovation Solutions (DIS), the economic analysis firm tasked with conducting the consumption report, established a baseline of the value and volume of feed for six major categories of livestock and poultry (i.e., broilers, layers, turkeys, hogs, dairy cows and beef cattle) and then provided three, forward-looking economic scenarios for the feed sector beyond the COVID-19 crisis through 2025.

Results

The study found that in 2019, pets and domestic livestock in the United States consumed approximately 284 million tons of animal food. The top three feed consumers included beef cattle at 64.5 million tons, hogs at 61.8 million tons and broiler chickens at 60.8 million tons. Iowa, Texas, California, North Carolina and Minnesota topped the list for the sheer amount of animal food consumed with 28.8 million tons, 21.1 million tons, 17.5 million tons, 16.3 million tons and 14.6 million tons, respectively.

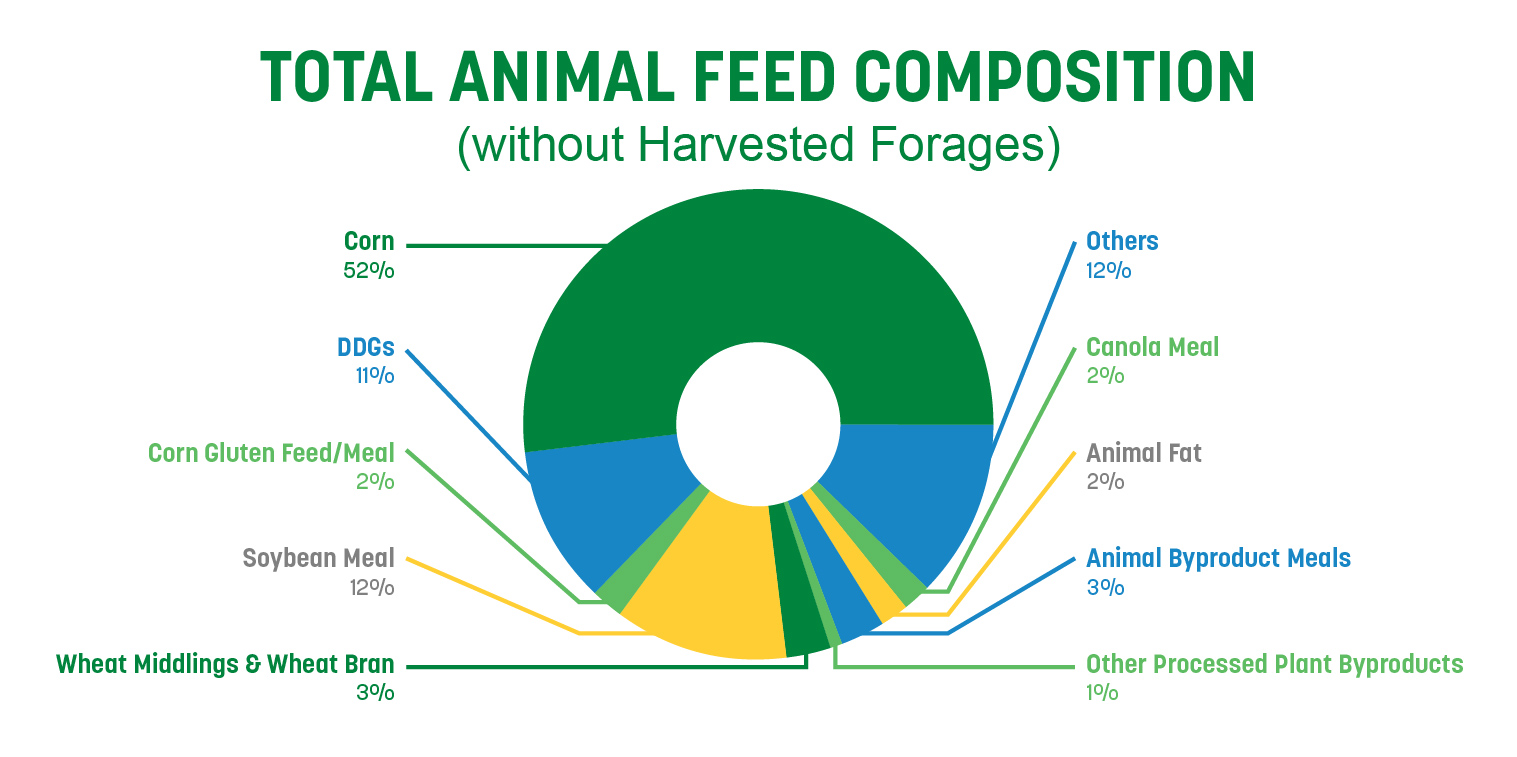

Corn, the most abundantly produced crop in the United States, made up slightly more than half (52%) of the total amount of compounded feed consumed, and when combined with soybean meal (12%) and dried distillers’ grains with soluble (DDGs) (11%), represented more than 75% of all feed tonnage consumed in 2019. DIS also reported on several other ingredients used in animal diets, including wheat middlings and wheat bran (3%), animal byproduct meals (3%), corn gluten feed/meal (2%), canola meal (2%), animal fats (2%), other processed plant byproducts (1%) and others.

COVID-19’s Impact on Industry

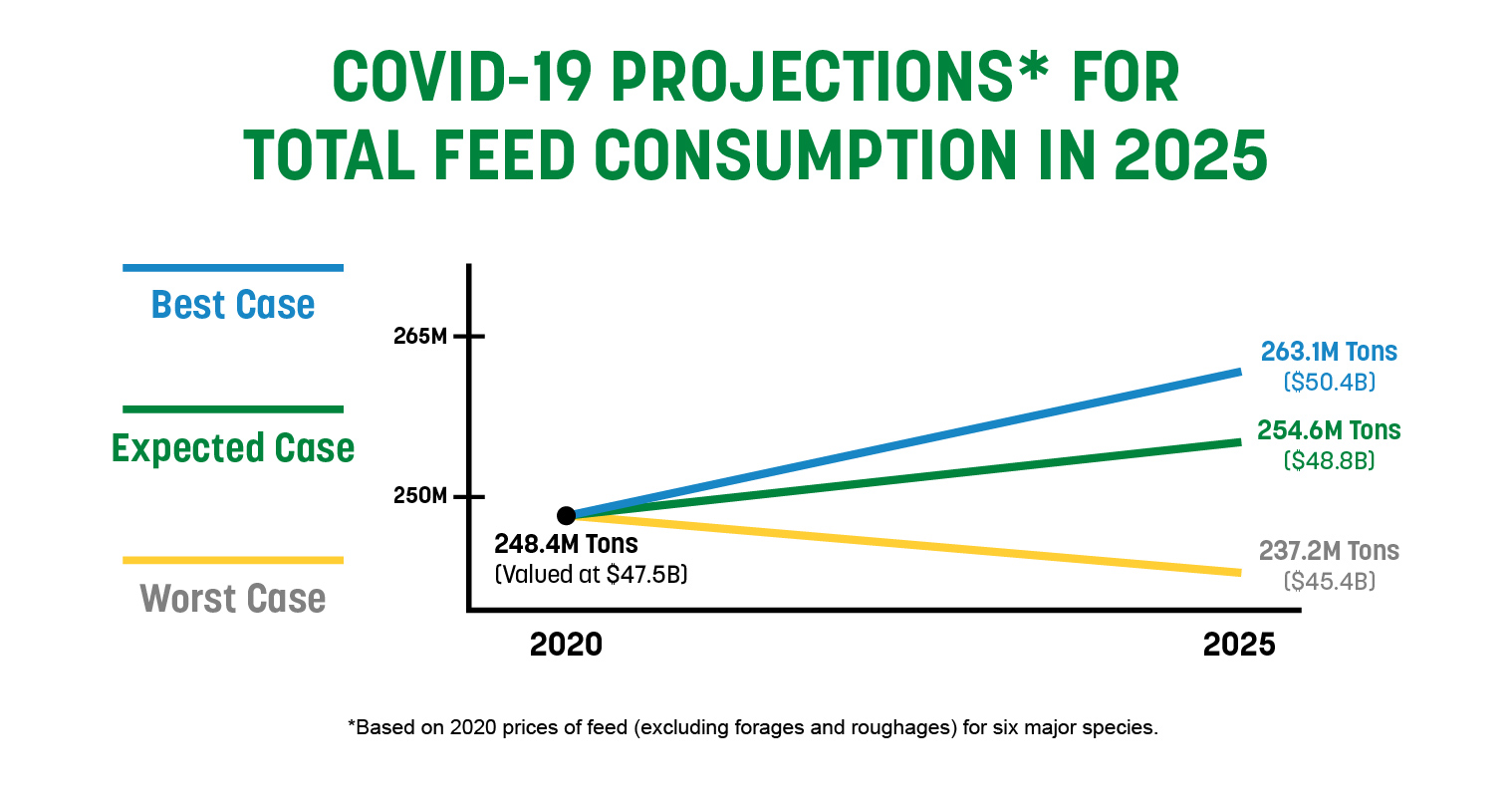

The research study considered six categories of domestic livestock production for this part of the report, including broilers, layers, turkeys, hogs, dairy cows and beef cattle. DIS estimated the baseline consumption at the beginning of 2020 at 252.6 million tons (excluding forages and roughages) with an estimated value of $66.7 billion, under normal production circumstances without the pandemic; with COVID-19, the consumption rate fell roughly 1.7% to an estimated 248.4 million tons, a difference of 4.2 million tons less feed consumed worth $1.6 billion, leaving the industry with a total post-COVID-19 value of $47.5 billion.

In a worst-case scenario, where the industry encounters further disruptions in processing and slaughter numbers or potential trade issues, DIS estimated that in 2025, animal food consumption could further decrease 4.5% to 237.2 million tons at a value of $45.4 billion. In an expected-case scenario, where the industry continues business as usual without any further major disruptions, DIS estimated that by 2025, animal food consumption could increase 2.5% to 254.6 million tons worth roughly $48.8 billion. In a best-case scenario, where the hotel, retail and institution sectors of the economy recover quickly and travel and trade conditions dramatically improve, DIS estimated that by 2025, feed consumption could increase 5.9.% to 263.1 million tons, valued at $50.4 billion.

Learn more about the animal food consumed in your state.

Resources

- Full report

- News release

- National handout

- Blog

- Social Media Toolkit

- Downloadable graphics

- PowerPoint Presentation (Members-only)

- Animated Video

COMING SOON!

IFEEDER recently launched a project to update its feed ingredient consumption report with the latest data and is looking for project partners. Learn more>>