Written by: Madison Wyman | June 19, 2024

The American Feed Industry Association (AFIA) has maintained a strong presence in Vietnam despite the ever-changing global markets, intense competition and general uncertainty. By staying informed and open to new opportunities, the AFIA provides Vietnamese feed companies with valuable insights into U.S. feed additives. Through meetings with stakeholders in Vietnam, our global policy team has gathered crucial data, shedding light on the industry’s efforts to compete in Vietnam’s feed additive sector. Through Market Access Program funds provided by the U.S. Department of Agriculture, meetings with stakeholders in Vietnam, our global policy team has gathered crucial data, shedding light on the industry’s efforts to compete in Vietnam’s feed additive sector.

Respondent Information:

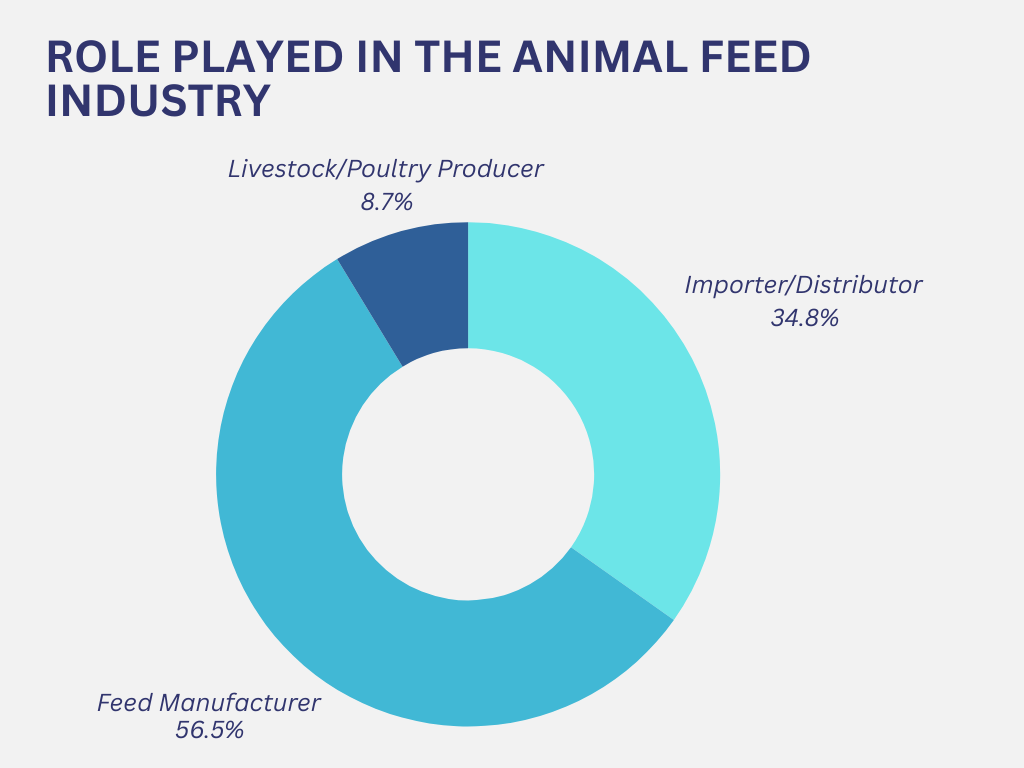

I worked with our global policy team to break down survey results from recent analysis from individuals representing a range of companies within the Vietnamese animal feed industry. These respondents offered diverse expertise, with their experience in the industry spanning from novices to 30 years of experience. The survey respondents represent operations across various regions in Vietnam, including 39% operating throughout the entire country, 9% in Toàn Cu and 4.35% in the Mekong Delta, Ho Chi Minh City, the Northside and the Central region, while 35% did not specify their operating region.

Awareness and Understanding

AFIA’s work in Vietnam has focused on bringing awareness to the variety of products U.S. feed ingredient manufacturers can provide and fostering a better understanding of the utilization of these additives and ingredients.

After several webinars and an in-person workshop, 72% of the Vietnamese respondents reported being somewhat familiar to very familiar with U.S. feed additives, with only 28% of respondents reported being not familiar. Of the respondents, nearly 70% perceive the quality of U.S. feed additives much higher or somewhat higher than those from other countries.

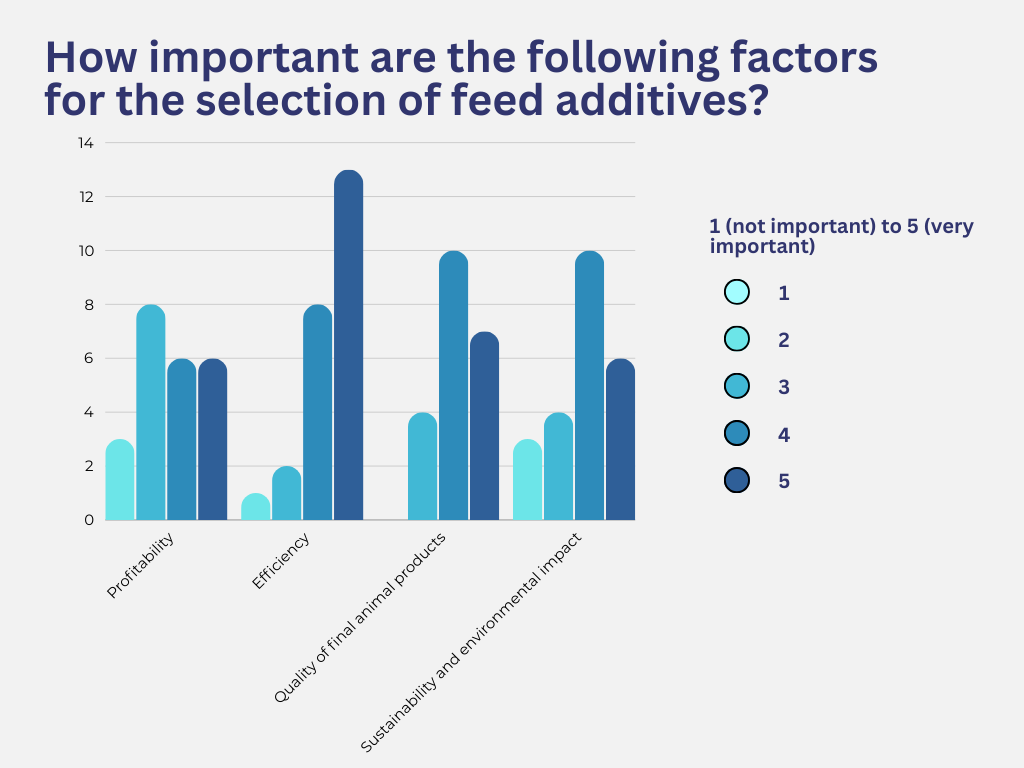

Those surveyed were also asked about what factors are important when selecting feed additives: profitability, efficiency, quality of final animal products (i.e., eggs, meat), sustainability and environmental impact. The ratings for profitability show a moderate distribution, with the highest concentration around ratings three and four, out of five, suggesting that while profitability is a significant factor, it may not be the most critical consideration for many respondents.

Efficiency is rated highly, with a noticeable peak at rating five, indicating that many respondents consider it to be a crucial factor when selecting feed additives. The quality of the final animal products also shows a high importance, with a strong peak rating of five, demonstrating that high-quality end products is a top priority for many in the Vietnamese industry. Sustainability and environmental impact also exhibited a varied distribution, with a notable peak at rating four, suggesting that while some respondents prioritize these factors highly, others may place less emphasis on them. The higher rating on sustainability and environmental impact could also be a trickled down emphasis from the Vietnamese government’s agenda and evolving regulations in this space.

Overall, the data reflects that feed efficiency, and the quality of final animal products are highly valued by industry respondents, followed by considerations of profitability and sustainability.

Preferences

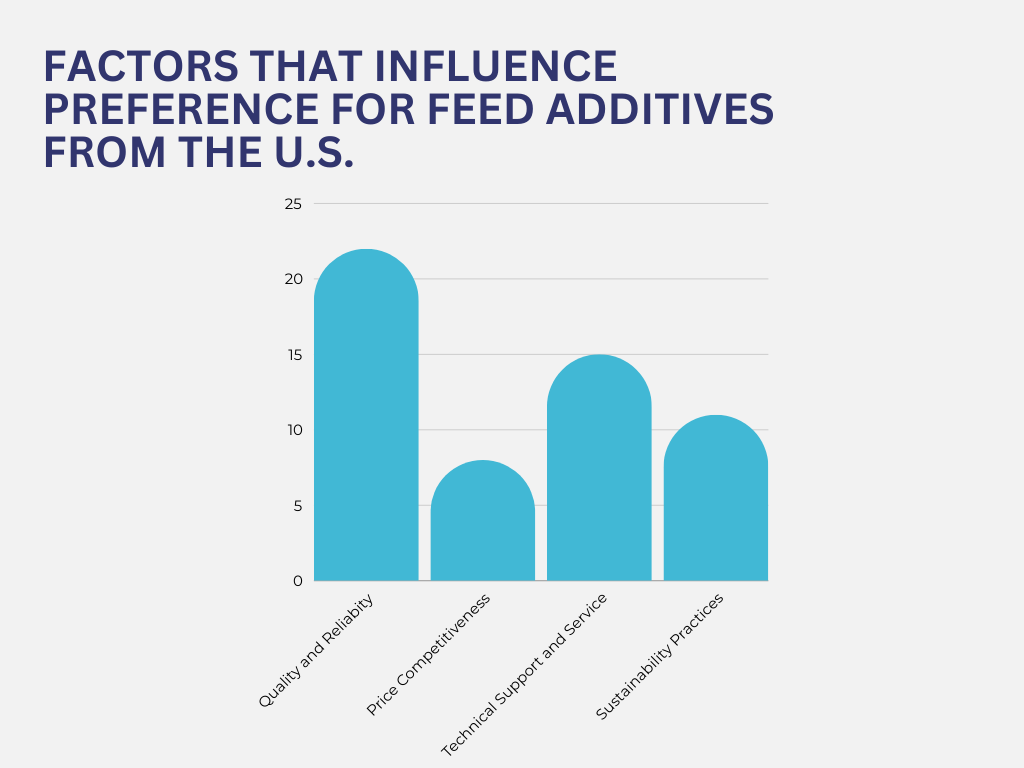

The survey also analyzed several key factors that influence Vietnamese stakeholders' preferences for U.S. feed additives. A predominant factor is the reputation of U.S. products for high quality and reliability, stemming from the reputation of regulatory standards and practices in place in the United States. Specifically, nearly 96% of respondents cited product quality as a critical factor in their preference for U.S. feed additives.

Purchasing Behavior

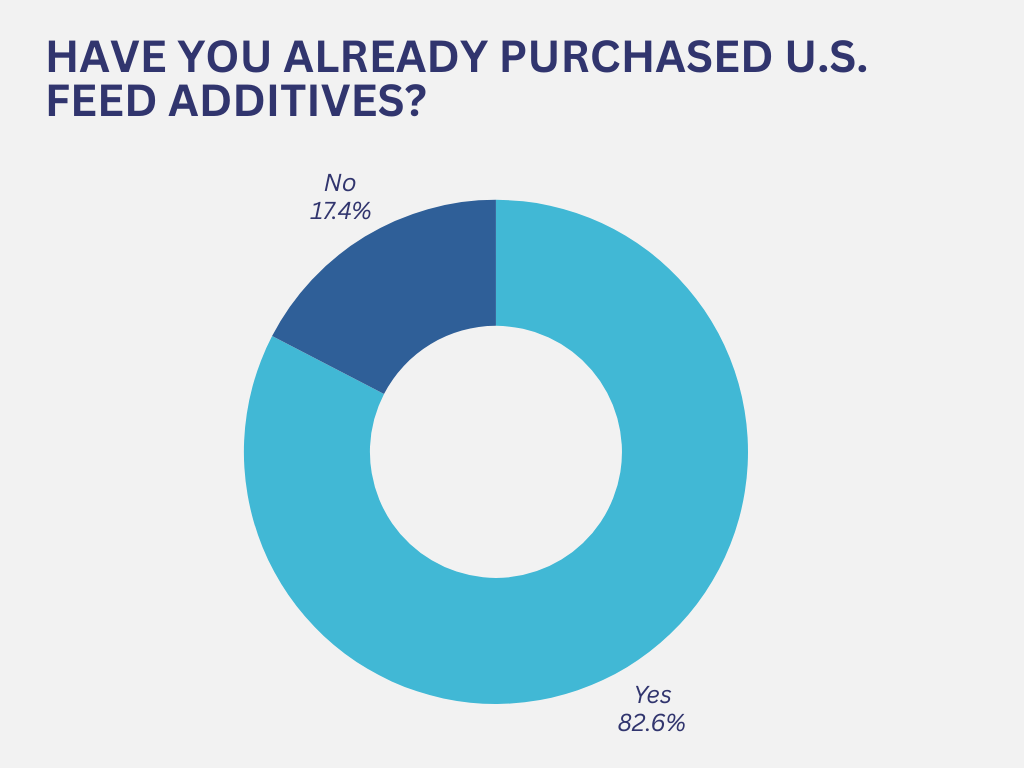

While nearly 87% of respondents indicated that their interactions with the AFIA, through events and informational documents, positively or somewhat influenced their decision to purchase U.S. feed additives, there are still certain barriers limiting the Vietnamese animal feed industry from purchasing U.S. products. Specifically, nearly 70% of respondents mentioned higher prices as the main reason for not purchasing U.S. products, despite the fact that they said cost is not a significant barrier to using better feed additives. A factor in this may be that a lack of sufficient information has become a deterrent, with nearly 48% of respondents highlighting the need for more efficacy and usage of these additives prior to purchasing them.

While nearly 87% of respondents indicated that their interactions with the AFIA, through events and informational documents, positively or somewhat influenced their decision to purchase U.S. feed additives, there are still certain barriers limiting the Vietnamese animal feed industry from purchasing U.S. products. Specifically, nearly 70% of respondents mentioned higher prices as the main reason for not purchasing U.S. products, despite the fact that they said cost is not a significant barrier to using better feed additives. A factor in this may be that a lack of sufficient information has become a deterrent, with nearly 48% of respondents highlighting the need for more efficacy and usage of these additives prior to purchasing them.

Future Intentions

The survey explored the future purchasing intentions of Vietnamese stakeholders regarding U.S. feed additives, based on their current knowledge and experiences.

Another significant finding worth mentioning is that roughly 91% of respondents indicated a strong intention to buy U.S. feed additives in the future. This positive outlook is driven by the benefits and high satisfaction levels with the information AFIA has presented on the quality and value of U.S. animal food products. Roughly 22% of respondents highlighted the importance of ongoing technological seminars from AFIA as a key factor in their future purchasing decisions.

These findings highlight the strong reputation and perceived quality of U.S. products, coupled with AFIA's engagement and educational efforts, are directly contributing to a high probability that the Vietnamese agricultural community will consider U.S. products in their future purchases. The ongoing commitment to innovation and education will be pivotal in maintaining trust and interest in U.S. feed additives, ultimately fostering long-term relationships and growth in this dynamic market.

Comments See our policy on comments