Written by: Madison Wyman | July 1, 2024

In addition to the feed additives survey the American Feed Industry Association recently conducted in the Vietnamese market, we also reached out to the pet food industry for their thoughts. Through Market Access Program funds provided by the U.S. Department of Agriculture, meetings with stakeholders in Vietnam, our global policy team has gathered crucial data, shedding light on the industry’s efforts to compete in Vietnam’s feed additive sector.

The pet food survey provided a comprehensive look at Vietnamese small animal veterinarians’ preferences, awareness and perceptions of U.S. pet food. This survey, which garnered responses from 39 Vietnamese veterinarians, aimed to understand how participants perceive U.S. pet food brands and what factors influence their recommendations.

perceive U.S. pet food brands and what factors influence their recommendations.

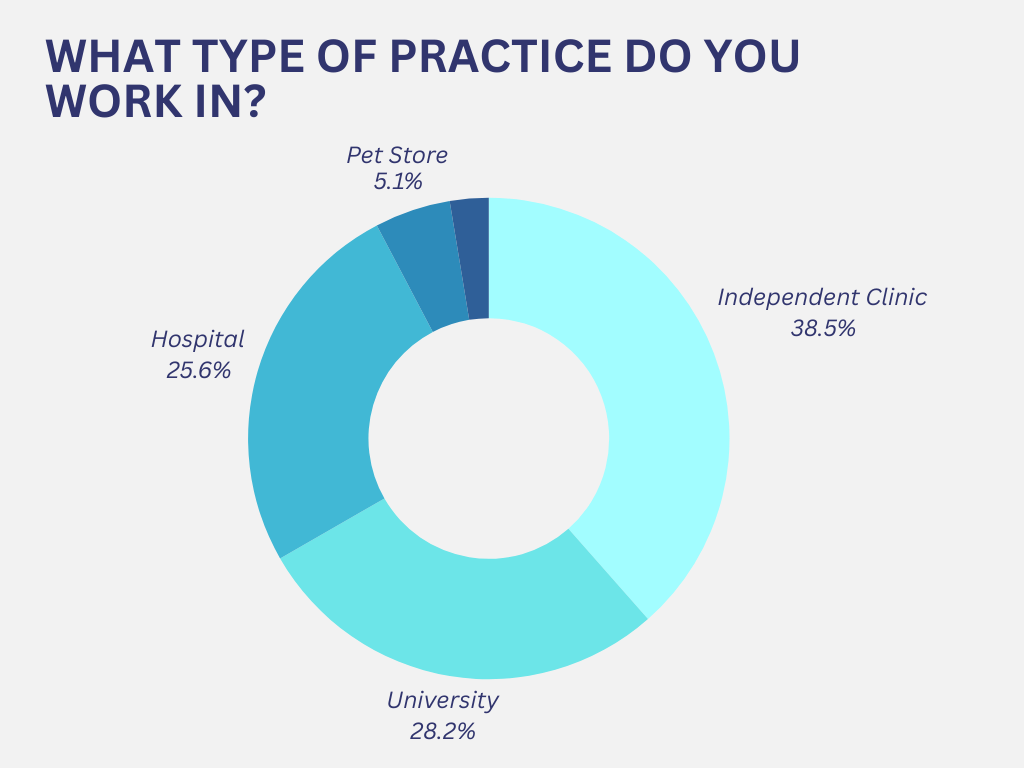

Respondent Demographics

This demographic snapshot sets the stage for understanding the depth and nuances of veterinarians' perceptions and recommendations. The respondents varied from a year of practice to 23 years of practice, with the most respondents having been in the field for 10 years.

Awareness and Understanding of US Pet Food

The survey asked veterinarians to rate their familiarity with U.S. pet food brands on a scale of 1 to 5, with 5 being the most familiar and 1 being the least familiar. This metric helped gauge the overall visibility and recognition of U.S. pet food in the Vietnamese market.

Approximately 47% of the respondents ranked their familiarity at a 3, and 26% rated their familiarity at a 4 or 5. The survey also asked participants to compare their knowledge of the nutritional benefits of U.S. pet food to other brands. Understanding how U.S. pet food is perceived in terms of its nutritional value is crucial for assessing the industry’s competitive edge in the market. Roughly 18% of veterinarians viewed the U.S. brands much higher in nutritional benefits than other brands, 33% reported them as somewhat higher, 31% as about the same and 18% as somewhat lower.

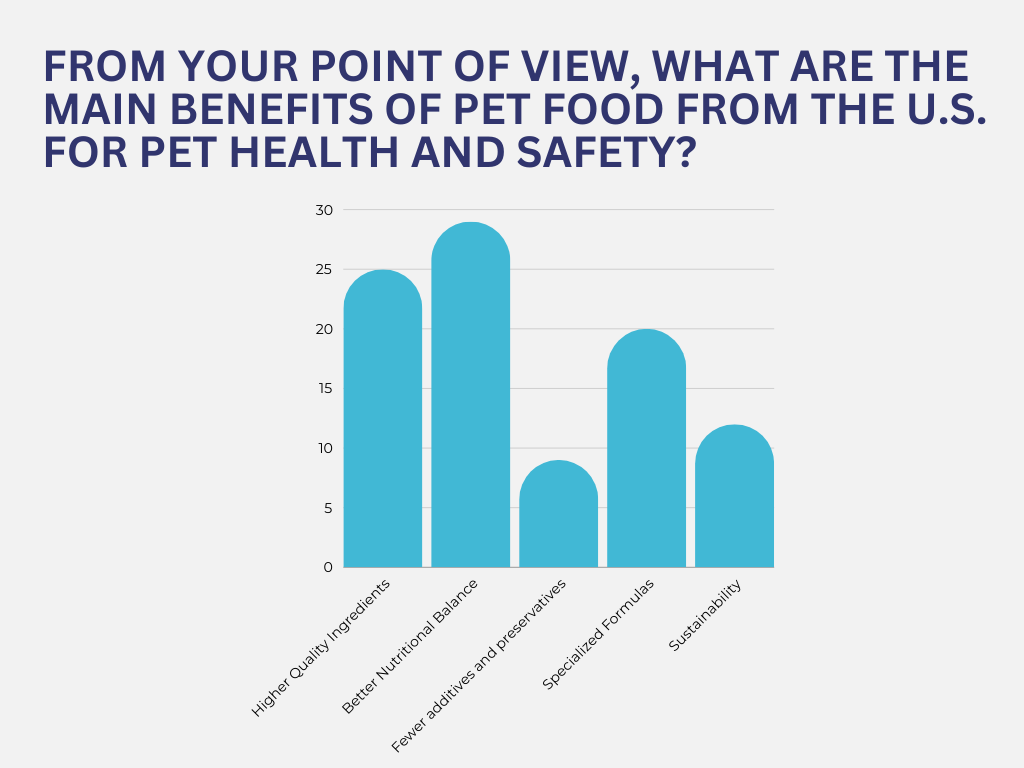

Perceptions of US Pet Food

Veterinarians highlighted several benefits of U.S. pet food for pet health and safety, including higher quality ingredients, specialized formulas for health conditions, sustainability and ethical sourcing. The survey also inquired whether veterinarians had observed any health improvements in companion animals fed with U.S. pet food compared to other brands. Approximately 46% of the veterinarians stated that they saw health improvements in pets who consumed U.S. pet food compared to other brands, while 33% reported being unsure if U.S. pet food improved animal health and 13% reported that they had not come across pets that have been fed U.S. pet food. Of the 46% who reported health improvements, 34% reported improved digestion and better coat condition, 19% reported better allergy management, 9% reported improved weight management and 3% reported all the above except allergy improvement. This practical insight helps quantify the perceived efficacy of U.S. pet food.

Veterinarians highlighted several benefits of U.S. pet food for pet health and safety, including higher quality ingredients, specialized formulas for health conditions, sustainability and ethical sourcing. The survey also inquired whether veterinarians had observed any health improvements in companion animals fed with U.S. pet food compared to other brands. Approximately 46% of the veterinarians stated that they saw health improvements in pets who consumed U.S. pet food compared to other brands, while 33% reported being unsure if U.S. pet food improved animal health and 13% reported that they had not come across pets that have been fed U.S. pet food. Of the 46% who reported health improvements, 34% reported improved digestion and better coat condition, 19% reported better allergy management, 9% reported improved weight management and 3% reported all the above except allergy improvement. This practical insight helps quantify the perceived efficacy of U.S. pet food.

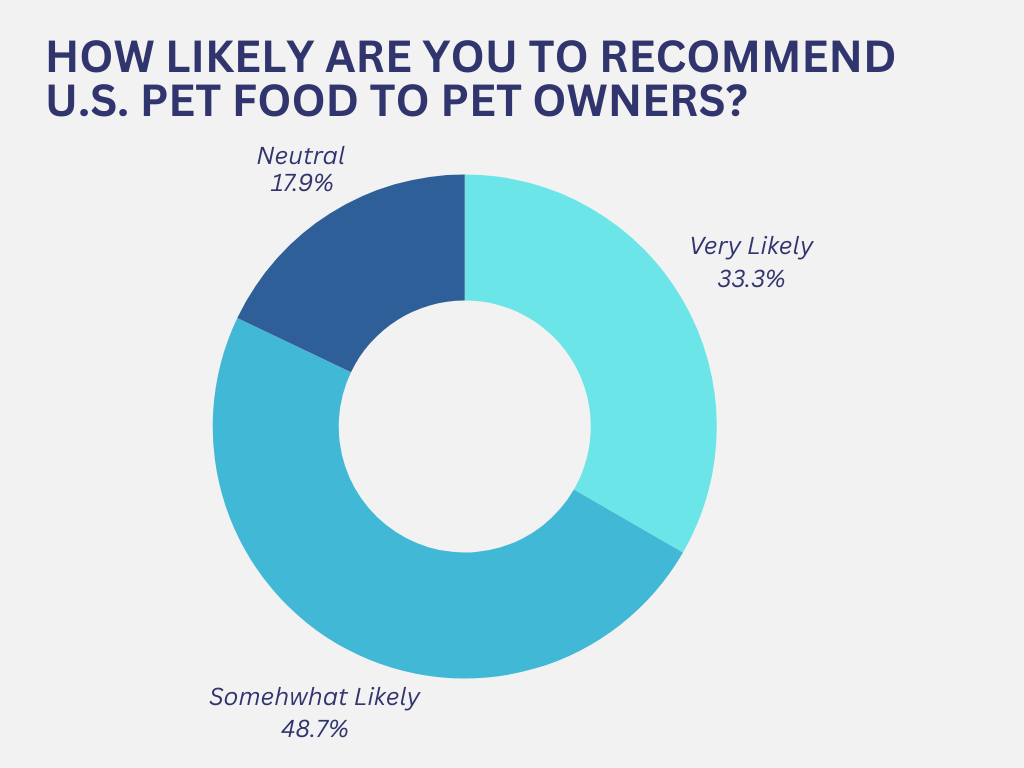

Recommendations and Preferences

The survey delved into the factors that influence veterinarians' recommendations of pet food brands to pet owners. Factors such as brand and quality, trust in the brand, and regulation by the U.S. government, and product specialization for chronic diseases were significant. Improvements in pet skin, fur and waste odor were also noted, along with the suitability for the pet's specific health needs and the owner's financial capacity. Veterinarians observed that foreign customers and those with higher economic statuses tend to prefer international brands, including those from the United States. This insight is crucial for market segmentation and targeted marketing strategies.

Barriers and Improvements

Veterinarians identified several barriers to the introduction and use of U.S. pet food in Vietnam, such as cost levels relative to the Vietnamese economy, the need for more promotion to raise awareness and the need for specialization and clear supporting evidence for product benefits. Veterinarians also voiced concerns over pets’ taste preferences. Of the respondents 82% reported cost as a main barrier for the introduction of or use of pet food from the U.S. in Vietnam, whereas 31% cited availability, 51% cited lack of information, 36% mentioned client preferences and 3% cited weak marketing and taste.

To overcome these barriers, veterinarians suggested several improvements, such as adjusting cost levels and enhancing promotional efforts. They also suggested providing more information and subsidies, organizing seminars and product demonstrations and clear labeling of nutritional ingredients and benefits. Additionally, veterinarians emphasized training, such as through scientific seminars and product samples.

Moving Forward

The AFIA Pet Food Survey sheds light on the perceptions, preferences and barriers regarding U.S. pet food among Vietnamese veterinarians. The insights gathered highlight the strengths of U.S. pet food in terms of quality and specialization, while also pointing out areas that pet food exporters can address to increase their market penetration in Vietnam. By addressing these barriers and enhancing promotional efforts, U.S. pet food brands can better cater to the needs of the Vietnamese market and its veterinary professionals.

Comments See our policy on comments